From January 1 to March 31 2021 17 banks were fined over 1250521695 and 910192215. KCB Group KCBNR Equity EQTYNR Co-op Bank Kenya COOPNR StanChart Kenya SCBKNR and Diamond Trust DTKNR are 5 banks that faced AML fines.

Furthermore the bank did not perform enhanced due diligence for high-risk transactions as suggested by FATF.

When banks with aml violations rebrand. SEB Bank Fined 107 Million for Poor AML Measures. March 2020 Swedbank Fined for Serious Deficiencies in AML. The Bank Fines 2020 report reveals the list of banks that faced the biggest fines in 2020.

The worlds banks are continuing to struggle in their obligations to combat financial crime with AML fine values in 2020 already surpassing 2019 as firms are repeatedly sanctioned for the same. The fine was the largest in Paraguays history and the second the bank faced in two years. AML regulations contain measures that companies must take to detect and prevent financial crimes and these regulations are determined by AML regulators and are a guide for businesses.

As US and UK regulators note the Deutsche Bank AML manager didnt follow up on the warning on the grounds he had to prioritize his work and had too many cases to review. Banks and credit unions must ensure that they have in place compliance procedures that will ensure the reporting of SARs for the following situations. In practice transaction monitoring should be set up to detect.

Banks or the banking sector are under the AML obligations because they are at risk of financial crime. Deutsche Bank agreed to pay US150 million in penalties in the US for significant compliance failures in connection with the banks relationship with Jeffrey Epstein and correspondent banking relationships with Danske Bank Estonia. I known or suspected criminal violations involving insider activity in any amount.

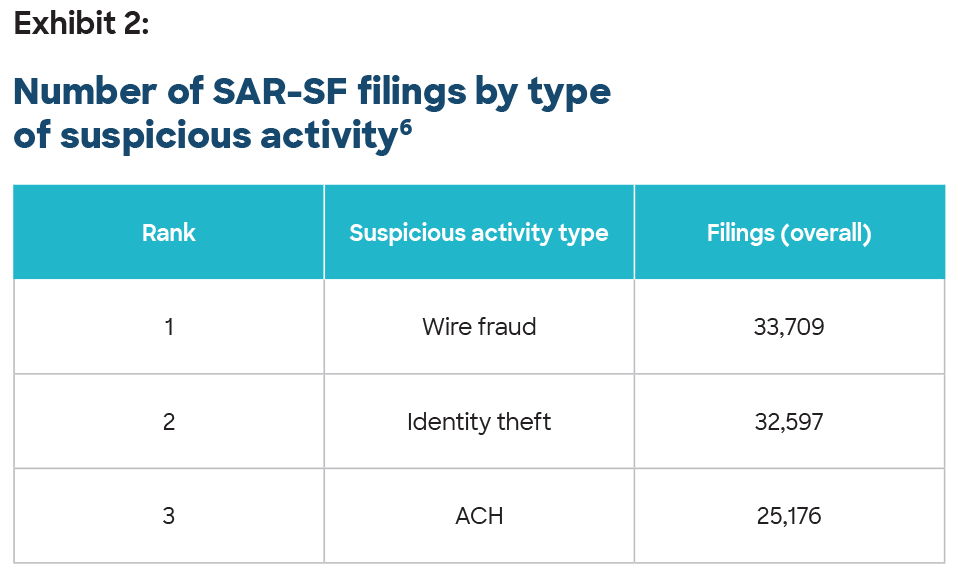

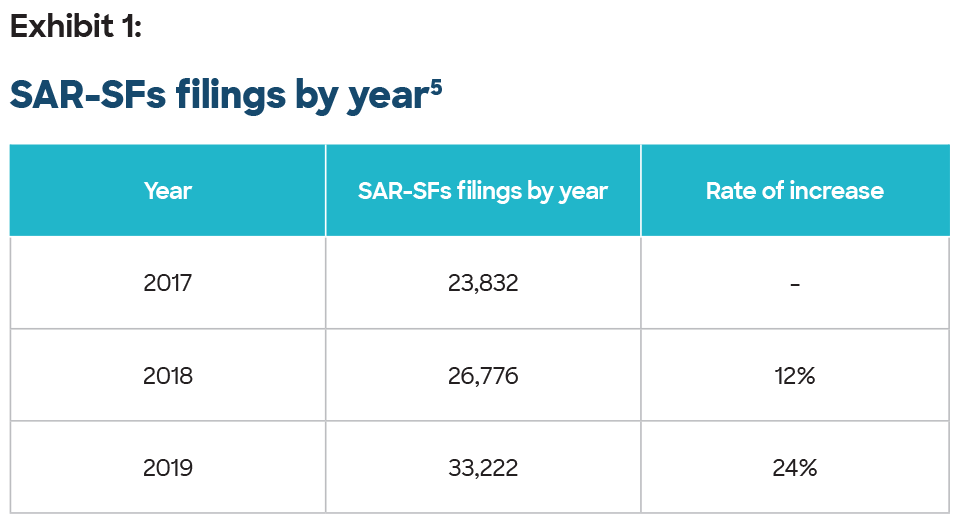

Our AML Bank Fines 2020 Report found that banks were fined over 3224875 355 billion and 2615333831 throughout 2020. Besides 5 banks were fined 4 million in Kenya in 2018 for not reporting suspicious transactions. In this report we share the total numbers summaries of each fine and actionable takeaways that.

Money laundering schemes are used to conceal the source and possession of money obtained through illegal activities such as drug trafficking and terrorism. Smaller banks just like the bigger ones need to fully understand and follow the 312 due diligence requirements if they open up accounts for foreign banks. When discussing the BSA violations at Lone Star National Bank FinCEN stated.

Westpac not only violated AMLCFT laws but also failed to employ transaction monitoring and did not submit IFTI reports to AUSTRAC. Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs. Anti-money laundering AML policies are put in place to deter criminals from integrating illicit funds into the financial system.

The financial institution failed to report suspicious activity to the regulator. Swedish lender SEB Bank was fined SEK1 billion US10711 million for failures in compliance and governance in relation to its AML regulations in the Baltics. AML laws were breached at different intervals.

AML checklists should focus on helping banks to deliver ongoing compliance which means monitoring customer transactions for suspicious activity in relation to their risk profile. There are hundreds of local and global regulators in total doing AML studies in the world. The cases are arranged in reverse chronological order and include the name and asset size when known of the organization penalized stated penalty amount agencies involved and key shortcomings noted in the organizations AML.

Yet another red flag appeared in early 2014 when a senior AML employee at Deutsche Bank was notified by an official at a Cypriot bank of his concerns about the identity of one of the counterparties to the mirror trades. Transactions above regulatory thresholds. The lapses which went undetected for years and were discovered as the result of an internal audit include a filtering gap that.

2021 is shaping up to be another blockbuster year for AML-related fines. Ii known or suspected criminal violations totalling 5000 or more when a suspect can be identified. By July 2020 penalties worth 56 billion were issued for non-compliance with AML.

Fines were imposed by regulators for breaches of different protocols like Anti-Money Laundering AML violation of Know Your Customer KYC and operating guidelines personal data leaks among others. Due to its deficient AML program Rabobank allowed hundreds of millions of dollars in untraceable cash allegedly money connected to drugs and illegal activities to be deposited into bank branches in Imperial County California and transferred via wire transfers checks and cash transactions without notifying US federal authorities as required. Unusual transactions for example transactions of.

When banks with aml violations rebrand themselves govern yourself accordingly This weeks news about the termination of a regulatory Consent Order at Miamis Brickell Bank by the FDIC is good news but remember the compliance rule. Globally fines on account of anti-money laundering and KYC violations accounted for 605 of all fines. Five commercial banks operating in Kenya were fined 375 million due to disruptions in AML compliance processes.

Deutsche Bank has identified serious failures in its screening of cheques and high-value electronic payments for anti-money laundering AML and sanctions compliance purposes the lender told the Financial Times. Banks and other financial institutions are legally obligated to follow AML regulations to. The Central Bank of Paraguay levied a record-breaking fine against Banco Itau a major Brazilian bank for failing to comply with AML regulations.

Paraguay AML Fines 2020. ACE inherently follows Bank Secrecy Act guidelines making it easier for banks to comply with AML requirements and avoid risk that leads to investigations and fines. Whenever you are looking at any entity check to see whether it has rebranded itself to escape a dark past that it doesnt want you to uncover.

Rabobank then defrauded the OCC. Encompass has carried out an analysis of Anti-Money Laundering AML related penalties handed down between 1 January and 31 December 2019 revealing that barring a massive 9 billion penalty in 2014 last year could have been a record at nearly double the. Iii known or suspected criminal violations totalling 25000 or more.

Tm2114322 4 S1a Block 37 4689482s

Anti Money Laundering Aml Investigation Money Laundering Case Management Investigations

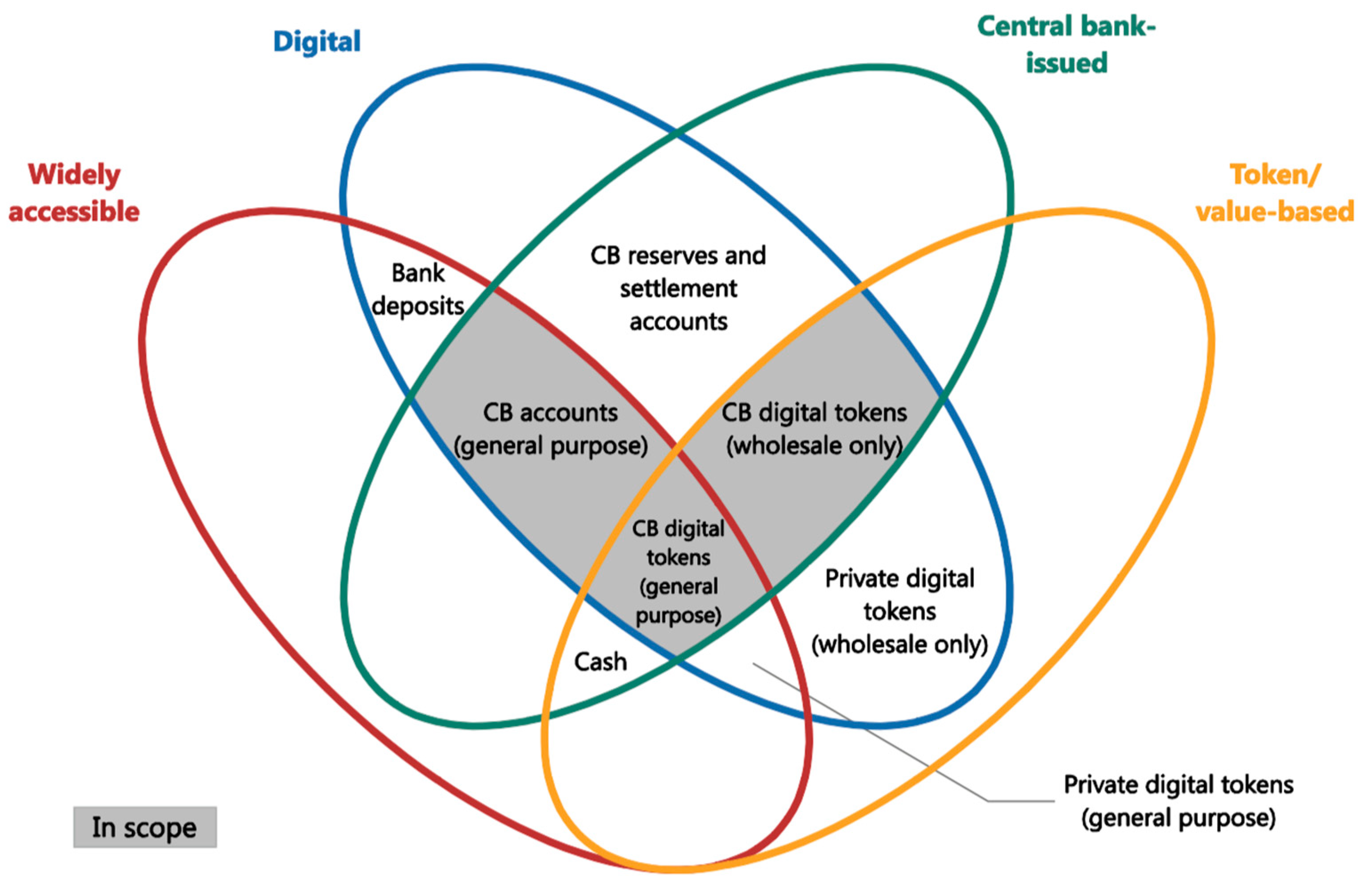

Imf World Bank And Bis Champion Central Bank Digital Currencies At G20 Blickblock Re

Don 039 T Waste Your Money How Scammers Use Zelle To Drain Your Bank Account John Matarese Wcpo

Fintech Magazine October 2020 By Fintech Magazine Issuu

Anti Money Laundering Aml Investigation Money Laundering Investigations Case Management

Asian Banking Finance October December 2016 By Charlton Media Group Issuu

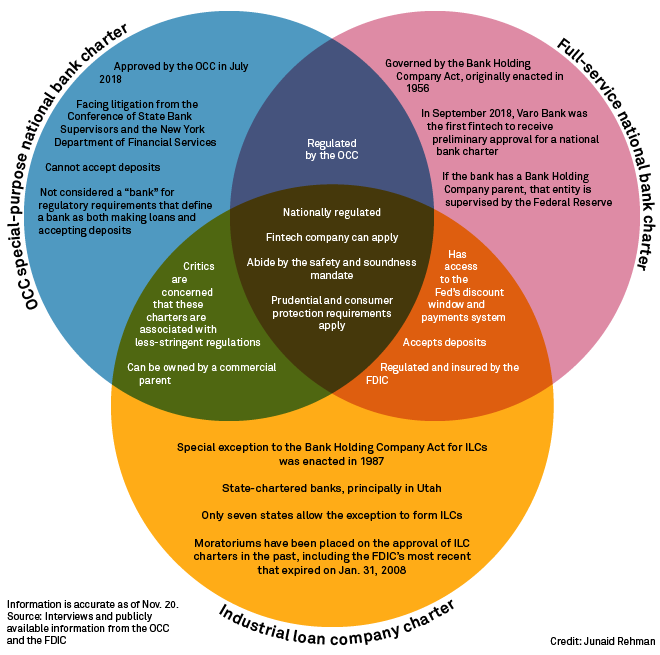

Robinhood Applies For National Bank Charter S P Global Market Intelligence

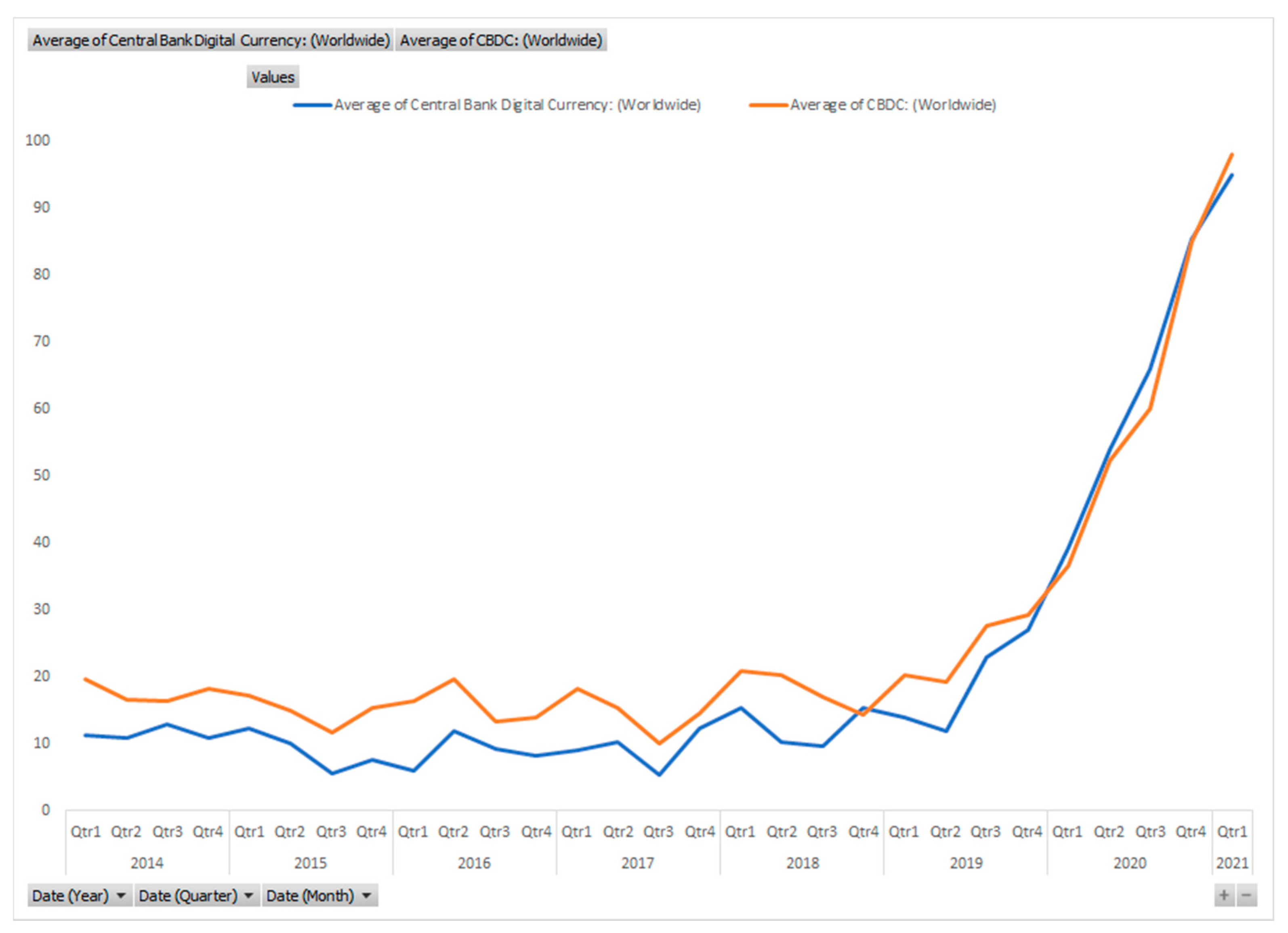

Future Internet Free Full Text From Bitcoin To Central Bank Digital Currencies Making Sense Of The Digital Money Revolution Html

Anti Money Laundering Aml An Overview For Staff Prepared By Msm Compliance Services Pty Ltd Bank Secrecy Act Act Training Money Laundering

Research Handbook On International Barrister Money Laundering

Anti Money Laundering Aml Ranks As One Of The Top Priorities Of Banks Worldwide Regulatory Age Money Laundering Evaluation Employee Employee Evaluation Form

Drs A 1 Filename1 Htm Use These Links To Rapidly Review The Document Table Of Contents Index To Consolidated Financial Statements Table Of Contents As Confidentially Submitted To The Securities And Exchange Commission On September 19 2019