The FIAU is a governmental agency having a distinct legal personality. ANTI-MONEY LAUNDERING REGULATOR S.

Anti Money Laundering Malta Professional Vixio

The world of money laundering is a fast-paced and ever evolving which can make it difficult for a financial firm to develop and maintain a strong anti-money laundering program.

Maltas anti money laundering program is. Malta has pledged to focus its financial intelligence capabilities on tax evasion and money laundering in a commitment to the Financial Action Task Force. The price of non-compliance can be great. This course is a perfect comprehensive way to learn how to moderate AML in the work place over Laws Directives Due Diligence Monitoring and Risks.

For they have created an economic miracle built on global tax evasion money-laundering and cheap labour. Maltas biggest bank failed for years to detect or address risks involving thousands of payments the European Central Bank ECB said detailing severe shortcomings that could have allowed money laundering or other criminal activities. Malta has plummeted 60 places in the span of a year in the Basel Institutes Anti-Money Laundering Index dropping from its low risk 113th place in 2019 to 53rd place in 2020.

A confidential ECB report seen by Reuters said Bank of Valletta BoV BOVMT had not dealt with a litany of risk management failings despite. A national risk assessment which the government is refusing to publish confirmed that Malta is at a high risk of being used for money laundering and of receiving foreign proceeds of crime. In Malta which is a hub for financial services and the online gaming sector anti-money laundering compliance is an important aspect of the commercial environment in which companies operate.

Maltese Legislation The various laws and standards aimed at combating money laundering and terrorist financing are being continually updated on international and local levels to respond to the evolving threats posed by criminals and terrorists. Malta retains minor deficiencies in the implementation of another twenty-eight Recommendations where it has been found largely compliant. Updated at 1230pm with government reaction below Maltas anti-money laundering regime has failed a review by international experts and the island now has a.

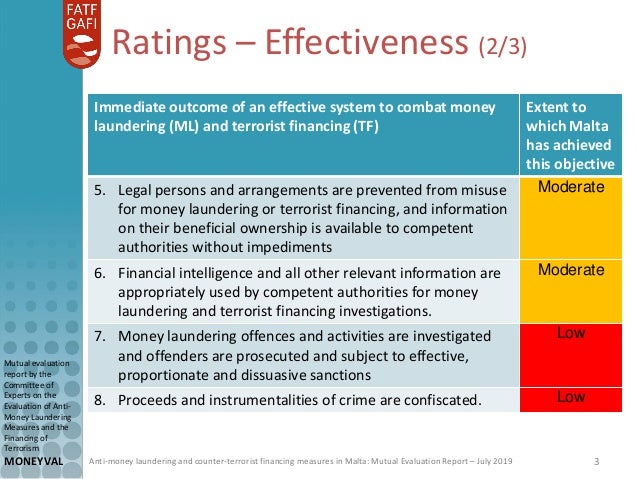

In the ninth edition published on Thursday the rapid decline now places. Furthermore Malta is part of MONEYVAL the Select Committee of Experts on the Evaluation of Anti-Money Laundering Measures formerly PC-R-EV established in September 1997 by the Committee of Ministers of the Council of Europe to conduct self- and mutual- assessment exercises of the anti-money laundering measures implemented in Council of Europe countries. The Council of Europe body had given Malta until last year to conduct an overhaul of its anti-money laundering legislation.

The monitoring of AML requires a formal and uniform approach to evaluate risk assess and secure a framework to mitigate attenuate and prevent money launderingcounter terrorist financing. Click on the following page links to access the applicable legislative provisions and recommendations. ICLG - Anti-Money Laundering Laws and Regulations - Malta covers issues including criminal enforcement regulatory and administrative enforcement and requirements for financial institutions and other designated businesses in 29 jurisdictions Published.

In 1994 Malta set up its own legislation the Prevention of Money Laundering Act Chapter 373 of the Laws of Malta which law makes it an offence to convert or transfer property knowing that such property is derived from crime the concealment or disguise of the true nature source location disposition movement rights with respect of in or over or ownership of property knowing that. Malta has achieved full compliance with twelve of the 40 FATF Recommendations constituting the international AMLCFT Anti-Money Laundering and Countering the Financing of Terrorism standard. The Maltese Prevention of Money Laundering Act PMLA imposes an obligation on financial institutions and other professionals to identify customers establish risk-based controls and report suspicious activities.

On this episode two FINRA anti-money laundering experts discuss current priorities and best practices when it comes to AML regulation. Aside from the real risk of criminal prosecution and administrative sanctions AML shortcomings can have. Malta continues to enhance its regulation of the financial services sector and passed additional legislation in 2014 and 2015 to improve anti-money laundering oversight for.

Malta has passed the Moneyval assessment after strengthening its ant-money laundering regime government sources have confirmed. It is responsible for the collection collation processing analysis and dissemination of information of suspected money laundering or terrorist financing activities in order to combat money laundering and terrorist financing in Malta.

Infocredit Group Lexisnexis Risk Solutions Sponsor The Anti Money Laundering Conference In Malta Infocredit Group Securing Ease Of Mind

Anti Money Laundering Malta Aml Software Silo Compliance

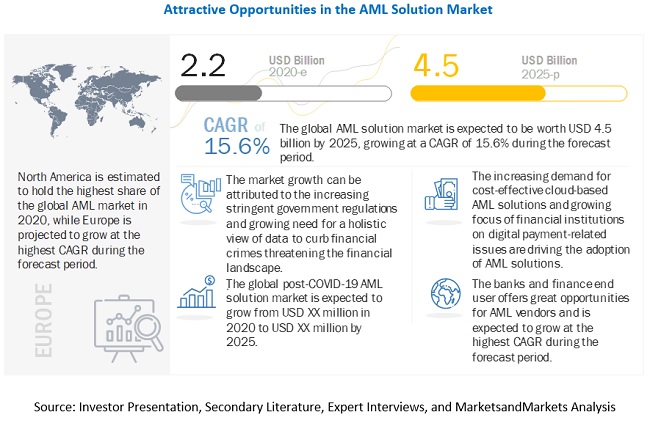

Anti Money Laundering Market Size Share And Global Market Forecast To 2025 Marketsandmarkets

Anti Money Laundering Malta Professional Vixio

Anti Money Laundering Malta Professional Vixio

Anti Money Laundering Malta Professional Vixio

The Malta Gaming Authority Sets Up A New Anti Money Laundering Supervisory Unit Iagr Leading The World In Gaming Regulation

Anti Money Laundering 2021 China Iclg

Malta Money Laundering And Financial Crime

Anti Money Laundering Software Market Global Industry Analysis 2018 2025 Money Laundering Bank Secrecy Act Software Deployment

Handbook Of Anti Money Laundering Pdf Money Laundering Money Anti

Anti Money Laundering Malta Professional Vixio

Moneyval Malta Mutual Evaluation Ratings

Cryptocurrency Anti Money Laundering Report Q4 2018 Ciphertrace

Malta Faces 200 Spike In Money Laundering Cases

Streamline Anti Money Laundering Aml Compliance

Anti Money Laundering Malta Professional Vixio

Malta No Longer Non Compliant Rules Eu Anti Money Laundering Body